The last couple of weeks the city in which we operate, Houston, has had a lot of news coverage. If you’ve somehow missed the constant flurry of updates, a hurricane dubbed Harvey unloaded over 50+ inches of rain in our city. It’s the most extreme rain event in U.S. history. The disaster has left a devastating effect on many people’s lives, even though they may have done much to prepare themselves for the worst. We’ve discussed on this blog before how to prepare your business for bad weather, but sometimes even the best of preparations don’t stand up for what nature has in store. In the wake of the destruction and tragedy that has occurred as a result of the storm, our answering service team would like to share with you some steps to take, information to heed, and plans for the future for disaster recovery.

First things first, Contact your Insurance Company.

Call your insurance company as soon as possible. This may be a given to you but sometimes in the wake of a disaster, when you’re looking at all of the water and work ahead of you, it’s hard to decide where to start. The insurance company will fill you in about what your coverage entails. Oftentimes insurance doesn’t include flood damage. You may have a separate policy. You should be able to assess damage, estimate losses, and create a budget for rebuilding with the help of your insurance claims adjuster. This won’t all necessarily go down in the first phone call, though. You’re going to have many conversations with your insurance company over the following months. It’s good to get the conversation started immediately.

Documentation is MAJOR KEY.

You’re building a case so that your insurance company damages that have occurred. Make sure you’ll have all of the documentation you’ll need and more.

- Take A LOT of pictures. Back them up, too. You should ask your adjuster before throwing out items that have incurred damage, but if you do throw something out, make sure there’s documentation of it becoming damaged.

- Keep lists of damages and repair estimates. These lists should be detailed. If you business had to be shut down, you’ll need to provide information on the business lost in the

- Gather your business’s financial records. You’ll need proof of income the business was generating both before and after the interruption. Tax returns, monthly sales tax returns, business contracts, budgets and financial statements are all documents you’ll want to have.

- Stay organized. Know your insurance claim reference number, adjuster and insurance company contact information. Keep the above mentioned documentation organized so that you can refer to it when necessary.

Keep in contact with your insurance adjuster.

Make sure that your adjuster knows alternative methods to reach you in case your contact information is changing as result of the damage. Despite the trouble that you’re going through, keep in mind that in all of the information an adjuster will give you about your policy, they are just the messenger. Do not get angry with the adjuster for holes in your coverage.

Cleaning up the Mess

If the building you do your business in has incurred water damage, you’ll need to act fast to recover it. The following tips will help you clean up the damage to the material things needed for your business to operate.

Try to Dry

Open up your business’s windows, cabinets and closet doors. Use dehumidifiers, fans and desiccants to try to quickly salvage what you can. Another way to try to dry things out would be to lower your air conditioner as far as it can. Cold air will not hold moisture as well as hot air. Then, when things are dry, turn on the heat. But not for too long, or you’ll turn the place into a greenhouse. Remember, if your home (including furniture and other items) isn’t dried out within 24-48 hours, you should assume that you have mold growth and those items, be it furniture, sheet rock, or carpeting, need to be discarded.

Protect yourself

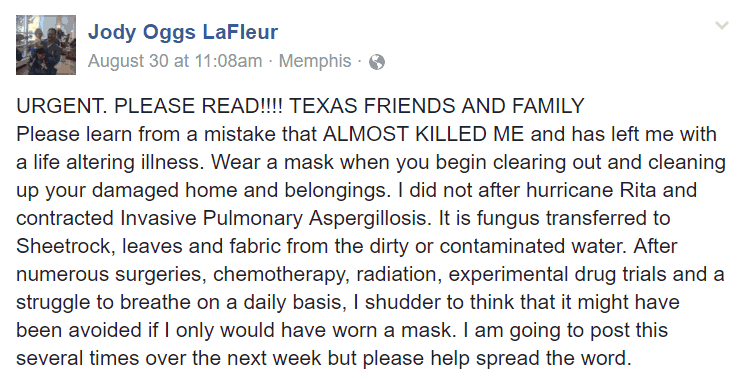

Be cautious and wear a mask rated N-95 or higher. You don’t want to take any chances. Heed this Facebook user’s advice:

If you’ve just come out of a flooding situation, that wasn’t just rain water that seeped into your place of business. Flood waters are full of bacteria that are harmful to your health. When drainage systems overflow, the untreated water gets mixed with the rainwater. It likely contains human waste. After Hurricane Katrina, there were five deaths and twenty-two illnesses that stemmed from a genus of Gram-negative bacteria called Vibrio. And that’s just one type of bacteria.

The dangers don’t stop when things seem to be dry, either. Mold is very hazardous and you don’t want it growing in your business’s walls. Exposure to mold can lead to asthma attacks, eye and skin irritation, and allergic reactions. It can lead to severe infections in people with weakened immune systems. Ensure mold cleanup is complete before reoccupying the workspace.

Laundry Lessons

For those of you who own small businesses that require linens in your inventory, you’ll need to know that laundering those items after a flood should be done a little differently. Click2Houston suggests a multi-step way to clean clothes after flooding, we suggest you do the same for any linens.

What to Remove vs. What to Clean

Wood, upholstered furniture and porous surfaces will need to be discarded. Drywall is particularly porous, and for that reason it should be removed. Carpet will also need to be removed, as drying it will not remove the mold spores that it likely holds. Glass, plastic and metal objects and other items made of hardened or nonporous materials can often be cleaned, disinfected and reused.

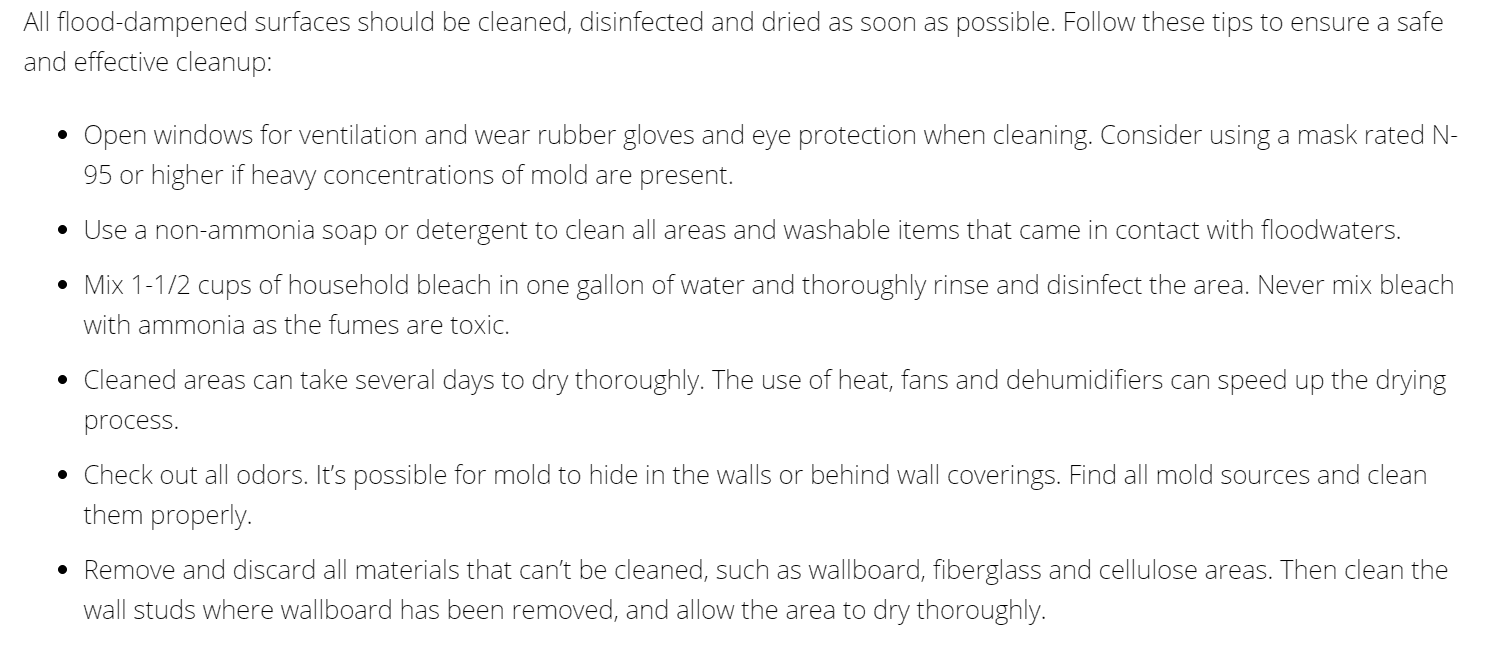

For the items that will need to be cleaned. follow the advice of FEMA:

Government Support

There are many different federal and local programs that can help you after a natural disaster. DisasterAssistance.gov can tell you which types of governmental assistance you qualify for in the wake of the disaster. Some of the programs are as follows:

Business Disaster Loans

Through the U.S. Small Business Administration, you can receive help in the form of a low-interest, long-term loan for losses not fully covered by insurance.

According to the information on their site,

Businesses of all sizes and private, non-profit organizations may borrow up to $2 million to repair or replace:

- Damaged or destroyed real estate.

- Machinery and equipment.

- Inventory and other business assets.

Disaster Unemployment Assistance

This program provides temporary benefits to people whose employment or self-employment has been lost or interrupted due to a major disaster. This program only applies to those who are not eligible for regular unemployment insurance benefits. Whether you can’t reach your job site, no longer have a place to work, can’t work due to an injury that happened because of the disaster, or a flurry of other reasons, you may qualify for this program.

American Job Centers Network

This program doesn’t just help job seekers. It also helps businesses. If a major disaster has caused a need for more employees, this network will help you find qualified workers. Check out their page Find Local Help to learn more about their programs and services.

Call your Creditors

It feels like your whole world stops when disaster strikes. But, disasters don’t happen in a vacuum. The debts you owed before are not automatically placed on hold. You’ll need to:

- Call credit card companies, mortgage lenders and/or vendors at your earliest convenience if you need to request a payment suspension.

- Any changes, temporary or long-term should have a written paper trail. New agreements should be in writing and you should keep the paper trail of correspondence with the creditor.

- Understand what you’re working with. The terms of a payment suspension can vary from creditor to creditor. Some creditors may expect a balloon payment for deferred installments at the end of the suspension.

- Remember to keep paying the other ‘little guys.’ Don’t suspend payments to other local small businesses. They need to rebuild, too.

Think about your Employees

You should be communicating frequently and frankly with your employees throughout a disaster situation. You don’t want a dedicated employee trying to get to their place of employment at a time that it’d be too dangerous to do so. Make expectations of attendance clear, with a focus on employee safety. Allow them to work from home and be flexible with their work hours.

A business owner is required to continue paying full-time exempt employees during business closure, per The Fair Standards Labor Act. You’re not required to pay non-exempt hourly employees, but you may want to consider helping out with lost wages in any way that you can.

If you’re not able to keep people on the payroll, let them know their resources by directing them to the the right government resources.

If you Don’t Speak Legalese…

You may want to speak to someone who does. Disaster assistance programs are available through your state bar association. These programs generally cater to those who are low-income. They can help you with replacing lost documents, insurance questions, landlord-tenant problems and consumer protection issues.

Think about Additional Resources

There are certain industries which receive a lot of business after a disaster occurs. Roofers, general contractors, insurance companies, and mechanics, to name a few. If you’re in an industry that has a sudden uptick of calls coming in, you may want to call for reinforcements and outsource your call-answering needs.

Apply this to your small business

Disaster can strike anytime, anywhere and planning can only get you so far. If your business has been struck by a disaster, act quickly.

- Call your insurance provider.

- Organize necessary paperwork.

- Clean up the mess left behind.

- Seek government support if necessary.

- Seek accommodations from your creditors.

- Keep your employees in-the-know and help them any way you can.

- Seek out a lawyer if need be.

- Reduce your call wait time by hiring a good receptionist.

Now, give this a try:

If you were lucky enough to get past Harvey unscathed, you may be curious how you can help others who weren’t so fortunate. Use some of these resources to help:

- SketchCity’s #Harvey Shelter Availability & Volunteer Needs Database

- Register you or your organization to help at Volunteer Houston

- Join the Hurricane Harvey Helping Hands Facebook Group

- Donate to a local charitable organization like BakerRipley